February 2026 | 3846 words | 15-minute read

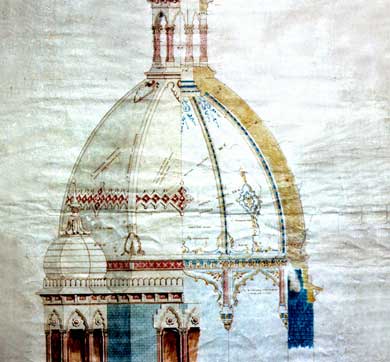

On clear mornings, as sunlight illuminates Mumbai’s harbour, the Indo-Saracenic façade of The Taj Mahal Palace, Mumbai glows in the manner of old cities where history and future thrive in seamless coexistence. Inside, guests revel in an experience that has defined luxury hospitality in India, and the gentle choreography of Tajness, perfected over 123 years. But beyond the timeless rituals of the Taj, a powerful new movement has gathered momentum, flowing outward from the iconic, Florentine-domed landmark to the far edges of India’s travel consciousness.

The custodian of the Taj since its inception, the Indian Hotels Company Ltd (IHCL) is now a 610+, multi-brand hotel behemoth. It is expanding with a conviction that is both audacious in ambition and disciplined in design, rebuilding itself as a branded house, while remaking the hospitality sector at a pace and scale never seen before.

“For over a century, IHCL’s iconic Taj brand has epitomised the very best of Indian hospitality,” says Puneet Chhatwal, Managing Director and Chief Executive Officer, IHCL, and the orchestrator behind the most remarkable transformation in the country’s hospitality history. “IHCL has remained resilient and relevant through the times. As custodians of this legacy, we are responsible for enriching this institution for the next century.”

By the numbers

FY2017 → FY2025

- Revenue: Rs 4,076 crore → Rs 8,565 crore

- EBITDA margin: 16% → 35%

- Net profit: - Rs 3 crore → Rs 1,908 crore

- Rs 3,159 crore debt → Cash positive Rs 3,000 crore

Expansion

- Portfolio: ~150 hotels → 610+ hotels (253 in the pipeline) in 250+ locations

- Signings: 250 YTD (CY2025)

- Openings: 121 YTD (CY2025)

- Domestic footprint: 570+ hotels, 56,000+ rooms

- International footprint: 36 hotels across 14 countries

Target 2030

- 700 hotels

- Rs 15,000 crore revenue

- 20% ROCE capex

The arc of reinvention

Preparing IHCL for the future is exactly what Mr Chhatwal and his team have been doing since he took the reins in 2017. In FY25, IHCL was Rs 3,000 crore cash positive, clocked a PAT of Rs 1,908 crore and an EBITDA margin of 35% — an “all-time high,” as N Chandrasekaran, Chairman, Tata Sons, noted at the company’s AGM in July 2025.

The strong growth has continued in FY26. “Q2 marks IHCL’s 14th consecutive quarter of record financial performance with a revenue of Rs 2,124 crore, a 12% growth over the previous year and a strong EBITDA margin of 30.8%,” says Mr Chhatwal.

However, it was a very different story in 2017 when Mr Chhatwal took over. IHCL had been on a loss-making trajectory for seven years, and posted a consolidated net loss of Rs 63 crore and a debt of Rs 3,159 crore. IHCL set off its transformation journey in 2018 with a vision to become the most iconic and most profitable hospitality ecosystem by addressing India’s heterogenous hospitality landscape.

The transformation hinged on a shift in world-view: accepting that the Taj alone could not carry the weight of IHCL’s (and India’s) hospitality future. IHCL would have to create a multi-brand ecosystem that could transport travellers everywhere they wanted to go — from metros to new industrial corridors, from wellness destinations to spiritual lighthouses, from homestays in popular weekend escapes, to boutique and experiential circuits. IHCL’s mission was to cover every base.

The company kicked off its Ginger revamp in 2018, but the Covid-19 pandemic in 2020 temporarily derailed the hospitality sector — and with it, IHCL’s best-laid plans. During this critical phase, it swiftly pivoted to an asset-light model, opting to take on management contracts for hotels instead of owning properties, and launched Qmin, which offered online gourmet food delivery services for customers during the lockdown. As pandemic-induced restrictions eased, these bootstrap measures started to bear fruit. In FY22, IHCL recorded a consolidated revenue of Rs 3,211 crore, with EBITDA reaching Rs 560 crore. This momentum set the stage for its next phase of growth. IHCL announced a plan to re-engineer margins (achieve 33% EBITDA), reimagine its brandscape, and restructure its portfolio (grow to 300 hotels) by FY26. As 2024 rolled around, IHCL had more than delivered, setting the stage for a stronger growth trajectory.

IHCL’s revenue has grown at a CAGR of 10% since 2017, while market cap has expanded at a CAGR of 30%. Additionally, the company has also maintained its revenue per available room (RevPAR) leadership in key markets across its brandscape, fortified by prudent asset management initiatives and a strong focus on operational excellence. “This sustained performance is enabled by a combination of maximising operating leverage from our owned/leased hotels and high margin fee-based business of new hotel openings, and non-linear growth of over 25% from new and reimagined businesses, including TajSATS, Ginger, Qmin, amã Stays & Trails and Tree of Life,” says Mr Chhatwal.

The expansion engine

When IHCL unveiled its Accelerate 2030 strategy in November 2024, it stated that it would “expand its brandscape, deliver industry-leading margins, double its consolidated revenue with a 20% return on capital employed and grow its portfolio to 700+ hotels while building on its world-renowned service ethos,” says Mr Chhatwal. Thus, a layered brand portfolio has always been one of the key levers of the company’s expansion engine.

“IHCL has pivoted from a house of brands to a branded house, recognising India’s heterogenous market landscape,” says Mr Chhatwal. “A reimagined and expanded brandscape — with each brand being the most premium in its segment — has led to an accelerated growth momentum. Our strategic initiatives and the enablers have evolved to address the dynamic and diversified market landscape.”

A growing footprint

- 70+ in Goa

- 20+ in the northeast

- 40+ Gateway hotels, with a vision to scale to 100 by 2030

- Spiritual hubs like Ayodhya, Varanasi, Dwarka, Somnath and Tirupati

- Industrial and IT corridors in Gujarat, Maharashtra, Telangana, and Karnataka

- Resorts in Lakshadweep and Andaman Islands

On the global front, IHCL has recently expanded to:

- The Middle East: Makkah and Riyadh in Saudi Arabia; Dubai and Ras Al Khaimah in the UAE; Hamala and Manama in Bahrain

- Africa: Cairo in Egypt and luxury safari lodges in Kruger National Park in South Africa

- Europe: Landmark hotel in Frankfurt

- Asia: Boutique hotels in Bhutan

The company began rebalancing its portfolio across segments as early as 2018. Today, IHCL is a multi-brand platform spanning luxury palaces, urban micro-hotels, experiential boutique stays, bungalows and villas, lean-luxury conversions, and a growing portfolio of adjacent businesses, beyond hotels, like Qmin and TajSATS, for non-linear revenue streams. Under Accelerate 2030, mid-scale and upscale brands will be the volume engines, while luxury and boutique properties anchor brand equity and pricing power.

IHCL also addressed white spaces in its brandscape by entering into integrated wellness with Atmantan, boutique hospitality formats like Claridges Collection in the luxury segment, and Tree of Life and Brij in experiential leisure. Mr Chhatwal explains, “We grew our footprint in the mid-scale segment through strategic alliances and acquisitions with Ginger, continued to scale our iconic Taj brand, as well as upscale brands like SeleQtions, Vivanta, and the reimagined Gateway. amã Stays & Trails, our innovative concept of the premium homestay, also grew to a portfolio of 330+ bungalows over 50 destinations.”

This growth has been fuelled by a capital-light approach with select investments — another key lever of IHCL’s expansion strategy. The capital light share of the operational inventory was 44% in FY2017 and stands at 67% today. The model ensures shortened market entry cycles through conversions and contracts and margin protection by way of management and franchise fees even as the portfolio grows (high EBITDA, low capex). It also offers the company flexibility to enter new demand pockets without heavy ownership investments and deploy capital only where it creates differentiation (like flagship assets across brands) so as to manage risks.

The result: a company that moves with the agility of a disruptor, and the confidence of a 123-year-old institution.

Brandscape

Luxury

- Taj: Ranked World’s Strongest Hotel Brand and India’s Strongest Brand across sectors by Brand Finance, with leadership in palaces, landmark city hotels and beach and hill resorts

- Claridges Collection: Boutique luxury with historical charm

Upper upscale and upscale

- SeleQtions: Distinctive hotels with strong local narratives

- Vivanta: Stylish, contemporary and design-forward

- Gateway: Full-service, upscale hotels

Mid-scale

- Ginger: Smart, lean-luxe hotels for the millennial mindset

Boutique and experiential

- Tree of Life: Private escapes in tranquil settings

- amã Stays & Trails: Fastest-growing premium homestay brand

- Brij: Collection of boutique hotels in wildlife, heritage, spiritual tourism

- Atmantan: Integrated wellness offering

Ancillary businesses

- Qmin: IHCL’s culinary platform with online and offline formats

- TajSATS: Market leader in airline catering

- Chambers: Exclusive business club

India’s hospitality hunger

IHCL’s positioning reflects very clear indicators in the domestic travel market. India’s hospitality industry has been in the throes of a singularly transformational era. Rising per capita income means that travel is no longer a discretionary expense, with families keen to spend on trends and experiences, and demand curves are shaped by festivals, school cycles, corporate calendars and wellness habits, rather than just seasonality. Secondly, infrastructure development is pulling smaller cities into the economic mainstream, and improved connectivity has collapsed the psychological distance between once-remote regions.

However, India’s hotel supply, which has long been a bottleneck, is still far behind global benchmarks. “The hotel sector is experiencing double-digit revenue growth over successive quarters, and branded hotel supply, which took a decade to grow from one lakh to two lakh rooms, will leap to three lakh in just five years,” says Mr Chhatwal. “But India continues to be an underserved market, in comparison to markets like Singapore and Dubai, cumulatively.”

Bold moves

IHCL’s rapid growth has been supported by a series of acquisitions and partnerships in the last two years.

Acquisitions

- 51% stake in Atmantan, a luxury integrated wellness brand in November 2025

- 51% stake in ANK Hotels and Pride Hospitality, bringing 150+ hotels into the fold; to be rebranded predominantly under Ginger

- 55% stake in Rajscape Hotels - a subsidiary that operates Tree of Life resorts in partnership with Ambuja Neotia group

Distribution

Distribution/marketing agreement with Brij Hospitality for its boutique leisure portfolio and UP Hotels for its collection of hotels in the well-established tourist circuits of India’s historic cities of Benaras, Jaipur, Agra, and Lucknow.

Partnerships

- Operating agreement with Madison for 10 new Ginger hotels across South India, 1,000+ keys

- Agreement with Ambuja Neotia to develop 15 new hotels across West Bengal, Sikkim, and Himachal Pradesh under Taj, SeleQtions and Tree of Life, taking the joint portfolio to 40+ hotels

- A partnership with Claridges Hotels to co-develop and operate the Claridges Collection brand

India’s tourism and hospitality sector is projected to increase to Rs 5 lakh crore ($60 bn) in 2028, driven by a sharp rise in domestic travel, and, as of March 2024, only 11% of India’s 34 lakh hotel rooms belonged to the organised sector, with 17% of these in the luxury segment (Source: IDBI Capital, September 2025). The premium hotel supply growth rate was a modest ~5%, while demand has increased by ~10%, according to an Investment Information and Credit Rating Agency report (January 2025). The stark demand-supply gap in the luxury space is reflective of evolving consumer preferences for premium stays. In this environment, IHCL’s speed is not only a competitive advantage but also a national necessity.

“India’s hospitality market, shaped by the country’s growing economic stature on the global stage, its diverse geographical landscape and rich history and cultural significance, remains underpenetrated and presents a significant opportunity,” says Mr Chhatwal. “With multiple demand drivers and accelerating development, the sector offers immense potential for sustained growth across all segments.”

A travel revolution — and the company that saw it coming

IHCL has been unapologetically India-first, and one of the earliest players in the hospitality business to clock the coming domestic travel surge, powered by some major structural shifts.

- The premiumisation of the Indian consumer, with demand for upscale rooms growing steadily in the 8-10% range year-on-year.

- Boom in weddings and meetings, incentives, conferences, and exhibitions (MICE), which has exceeded pre-Covid levels since 2022 across IHCL brands.

- The rise in spiritual tourism, drawing unprecedented footfalls and multi-fold hotel demand in Ayodhya, Somnath, Dwarka, Katra and Varanasi.

- Tier 2 and 3 cities and new industrial corridors emerging as strong demand clusters.

- A growing interest in remote tourist circuits, enabled by infrastructure development (new airports, highways).

- A shift towards experiential and wellness travel, including short-stays and weekend getaways.

IHCL has been building a presence in each of these markets through its brandscape. For example, the growing demand for high-quality accommodation in Tier 2 and Tier 3 cities and the rising trend of life-event celebrations drove the company to reimagine the Gateway brand. “Its relaunch responds to the shift in consumer behaviour and aims to deliver personalised, location-specific experiences that resonate with aspirational India,” says Mr Chhatwal. “The relaunch of Gateway aligns with IHCL’s broader strategy of offering the right brand for the right market. It plays a crucial role in markets where luxury offerings like Taj may not be viable, yet there is a strong demand for high-quality full-service hotels. Similarly, Ginger, which is in the mid-scale segment with the largest addressable market size, also has strong relevance across Tier 2 and Tier 3 cities.”

IHCL pioneered tourism in what are some of India’s most popular destinations today — whether it is the palace circuit in Rajasthan, that began with the Taj taking over the management of the Taj Lake Palace, Udaipur in 1971, or setting the stage for luxury tourism in Goa with Taj Fort Aguada Resort & Spa in 1974, or consolidating the popularity of God’s Own Country, Kerala, with the establishment of Taj Malabar Resort & Spa, Cochin in 1986.

Today, the brand has expanded prolifically in the northeast, a region of unblemished beauty and incomparable culture, that is capturing the imagination of travel enthusiasts and influencers. “We have also widened and deepened our footprint in existing and new markets across emerging micro markets in metro cities, state capitals, commercial centres, industrial townships and spiritual destinations,” adds Mr Chhatwal.

Global foray

Internationally, IHCL’s growth has been deliberate, strategic and selective. The company has a portfolio of 35 international hotels and is strategically expanding with its iconic Taj brand into gateway cities that have a significant Indian diaspora and business communities. In 2023, it also entered continental Europe with Frankfurt’s landmark Hotel Hessischer Hof in Germany. “Meanwhile, the Middle East remains a focal point, with projects in Makkah, Riyadh, Bahrain, and Ras Al Khaimah besides three operational hotels in Dubai,” says Mr Chhatwal. “Our foray into Bhutan with the opening of Taj in Paro and the upcoming Taj in Phobjikha, as well as three luxury wildlife lodges in Balule Game Reserve, Kruger National Park in South Africa, emphasise our dedication to sustainable luxury.” Further marking its strategic expansion in Africa, IHCL made its debut in Egypt in December, with the signing of Taj Cairo in the city’s historic Opera Square.

The future of India’s strongest brand

In 2025, Taj was named the World’s Strongest Hotel Brand by Brand Finance in its Hotels 50 report — for the fourth consecutive year — and it also retained its position as India’s Strongest Brand across sectors in the India 100 report. These recognitions reflect its brand equity as well as the deeply internalised service culture of Tajness.

Taj has anchored the luxury end of IHCL’s portfolio for decades, becoming synonymous with Indian hospitality. This year, Taj made history when Taj Lake Palace, Udaipur and Taj Falaknuma Palace, Hyderabad became the first Indian hotels to receive the prestigious Three Michelin Keys, signifying extraordinary stays, in the inaugural Michelin Key Guide for India 2025.

With over 130 hotels across 14 countries, Taj represents a unique portfolio of palaces, city hotels, safaris, spa resorts and service residences. It has brought many culinary firsts to India; it recently opened the third outpost of Loya at Taj Mahal Palace, Mumbai, and launched a Bombay Brasserie in Singapore, strengthening its international presence. Lastly, The Chambers remains India’s most iconic business club with a presence across nine Taj hotels including seven in India, and one each in Dubai and London.

IHCL is clear that the Taj brand will continue to redefine luxury while being rooted in its ethos. “There is a constant need to understand the brand’s history, keep an eye on current market trends and have a vision for the future,” says Mr Chhatwal. “The responsibility of sustaining a legacy brand involves balancing relevance to new consumers without alienating existing ones, managing stakeholder expectations, and consistently delivering on the brand promise.”

The force that powers excellence

IHCL’s service culture arguably remains its strongest competitive moat. Even as IHCL becomes larger, faster and more technology-driven, people remain at the heart of its business. After all, scaling up is not just a numbers challenge; it is also a people challenge. To its advantage, IHCL has always enjoyed a stellar reputation as an employer and trainer, and the company’s commitment to service excellence has consistently attracted professionals with a shared passion for hospitality and delivering exceptional guest experiences.

“We take pride in our 120+ year legacy, which inspires a deep sense of belonging among our workforce, and have a holistic approach to creating a workplace where talent feels valued, inspired, and committed to long-term growth,” says Mr Chhatwal. “Our talent management and investment in the growth and development of our associates, including our structured cadre and capability development programmes, is a benchmark in the industry.”

The company offers multiple programmes like the Hotelier Development Program, Hotel Operations Management Training, Ginger Leadership Program, Sales Executive Development Program, and scholarship programmes from renowned institutions like Les Roches and ESSEC Business School, among others. Through these programmes IHCL is shaping the next generation of Indian hospitality talent, creating a ready workforce for an industry where demand consistently outpaces supply.

Invisible infrastructure

Guests increasingly expect seamless, omnichannel experiences that prioritise loyalty and offer unique, immersive moments. IHCL has kick-started digital transformation across the hospitality value chain, with the goal of creating a connected, intelligent and scalable digital ecosystem that redefines guest experience, strengthens brand loyalty and supports sustainable long-term growth. It uses:

- Predictive analytics for revenue management

- AI-led personalisation for guests

- IoT-driven energy and water optimisation

- Digital-first customer journeys, like booking via IHCL platforms, and

- Tech-enabled back-of-house processes, like procurement and inventory

Purpose over profit

As custodians of India’s hospitality industry, IHCL has committed to skilling one lakh marginalised youth for hospitality careers by 2030. The undertaking — a significant pillar of the company’s ESG+ framework, Paathya — is focused on bridging the employability gap in the industry by creating skilled talent pools. Under this programme, IHCL has opened 73 training centres across India (most recently in Nainital) and announced plans for India’s largest hospitality skilling centre on the Aguada plateau in Goa.

Skilling is just one aspect of Paathya, which is IHCL’s holistic approach to sustainability, encompassing environmental stewardship, social responsibility, and ethical governance. Paathya is aligned to the Tata Group’s sustainability framework Aalingana and the associated commitments. “Sustainability is not a choice for IHCL; it is the only way forward and has become a cornerstone of our strategy, influencing key decisions across our operations,” states Mr Chhatwal. Paathya threads through every new build, every renovation, every supply chain decision, every community partnership, and is designed to improve operational efficiency, reduce utility costs and strengthen local ecosystems, while appealing to the conscious luxury traveller.

At the heart of Paathya is IHCL’s defining philosophy, its North Star, which guides its strategic choices, initiatives and actions: purpose. “Purpose is the whole journey!” says Mr Chhatwal. “Purpose has guided IHCL through its business cycles, including turbulent periods in 2008 and again in 2020. Our response to crises every time kept the community, our guests and our colleagues at the core. Organisations that prioritise purpose over profit discover that in doing so, they often achieve both in abundance.”

The Taj Public Service Welfare Trust (TPSWT), set up in the aftermath of the Mumbai terror attacks in 2008, is reflective of this philosophy. The Trust works on a range of relief and rehabilitation initiatives across the country and played a pivotal role during Covid-19.

The Paathya effect

In 2025, IHCL’s sustainability initiative saw:

- 51% of wastewater recycled, with a target of 100% by 2030

- 41% energy sourced from renewables, to be increased to 50% by 2030

- 74 bottling plants installed to reduce single-use plastic in hotels

- 382 EV charging stations installed across properties

- 73 skill centres set up, with 35,000+ beneficiaries across 20 states

Road map to 2030

IHCL’s 2030 ambition is bold but grounded in a decade of operational discipline, brand building, and strategic realignment. Over a century ago, the Taj Mahal Palace, Mumbai became a symbol of India’s arrival on a global stage. More than a century later, IHCL is building an entire ecosystem that reflects the complexity and momentum of India’s travel revolution.

“IHCL remains steadfast in its commitment to realise India’s tourism potential with its vision of Accelerate 2030, of being the most valued, responsible and profitable hospitality ecosystem in South Asia,” says Mr Chhatwal. “We will continue to generate industry-leading margins, remain net cash positive, deliver robust return on investment while maintaining our renowned service excellence.”

The company has identified growth levers that will propel it towards its goal of 700+ hotels, and Rs 15,000 crore in revenue — scaling keys across segments, developing new and adjacent businesses for non-linear growth, and a Rs 5,000 crore capital allocation towards brand building, renovations and property enhancements, select new builds and targeted acquisitions or partnerships.

But there is a deeper story here: that of a company orchestrating one of the most ambitious expansions in the global hospitality industry, of building on its stately heritage with the velocity of a modern juggernaut. It is the story of legacy refusing to stand still.

—Anuradha Anupkumar