May 2025 | 2650 words | 10-minute read

Resfeber. Fernweh. Yūgen. Wanderlust. So powerful and utterly universal is the pull of travel, the yearning to see new places and the allure of adventurous, offbeat experiences, that cultures across the world have been moved to invent unique words that capture the overwhelming human desire to go where the road takes us.

Indian travellers, especially, have never been more motivated by their desire to travel. In 2024, the World Travel and Tourism Council (WTTC) predicted that the travel and tourism sector in India would grow to Rs 43 lakh crore ($523 bn) in the next 10 years. Other reports are similarly optimistic; a 2023 Booking.com and McKinsey report said that in 2030, Indians would take ~5 bn trips (domestic and international), up from ~2.3 bn trips in 2019. The report also estimates that of the ~$410 bn Indians would spend on travel in 2030 (up from ~$150 bn in 2019), 35% or ~$143 bn would be spent on international travel (up from ~$34.2 bn in 2023), cementing the Indian traveller’s status as the fourth largest global spender in the near future.

Soaring aspirations

Staying in tune with Indian travellers’ aspirations, Air India declared its bullishness on the international travel — particularly, long-haul travel — market in January this year. The airline’s passenger share on routes to North America, Europe, the UK, Australia, the Far East and Africa went from 12% in January 2022 to 21% of the total market in 2024. “Home carriers typically have 30-40% market share of the international traffic originating from their countries; so we see a significant opportunity for further growth in this segment,” says Campbell Wilson, Chief Executive Officer and Managing Director, Air India. “Indian travellers’ growing demand for travel to international destinations and non-stop connectivity in a post-Covid world, as well as the huge Indian diaspora in the US, Canada, Australia and the UK, puts us in a unique position to serve this market from India.”

Now on your tray tables

TajSATS, a market leader with 60% share, provides air catering services to Air India and other international and domestic airlines. It clocked a strong revenue of Rs 770 crore, a growth of 18% over the previous year, in the first nine months of FY25.

The company is keeping pace with rapidly expanding airport infrastructure, growing its own operations to meet this demand. It has added new kitchens at Manohar International Airport in Goa and will soon operate a kitchen at the upcoming Jewar International Airport in Noida.

Air India is responding to some clear indicators — the increase in GDP per capita to ~ Rs 2.5 lakh in 2024 (up from ~ Rs 1.3 lakh in 2014) and the doubling of operational airports, from 74 in 2014 to 157 in 2024, and 400 by 2047. Plus, the Indian domestic aviation market, already the third largest in the world, is expected to grow three-fold by 2041, and the international market is growing even faster. “The opportunity for Air India’s expansion is dramatic,” says Mr Wilson. “The next decade will witness an expansion of our fleet, particularly the wide-body fleet and the connectivity of India to many more points around the world.”

Growing capacities

Following the merging of four Tata airlines (Air India, Vistara, Air India Express and AIX Connect), the company’s route network has grown 2X over the last three years and is now served by a full-service (Air India) and a low-cost (Air India Express) airline. The company’s daily frequency domestically has increased from 445 to 855, helping boost market share to 30%, whereas its daily frequency in the international segment has increased from 127 to 244 (short haul) and 30 to 69 (long haul), with the addition of Amsterdam, Milan, Copenhagen, Zurich, Ho Chi Minh City, Kuala Lumpur and Phuket.

To support this ambitious expansion, Air India group has inducted more than 100 aircraft, by adding new and leased aircraft, and bringing back grounded aircraft into service. This includes inducting India’s first A350. Air India has also embarked on a retrofit programme for its legacy fleet, starting with its narrow-body aircraft that is set for completion in mid-2025. Retrofit of the B787 wide-body aircraft will begin in April, while the B777 fleet will be retrofitted later.

Air India’s value-adds

- Daily flights to London Heathrow, New York and Newark on Air India’s flagship Airbus A350 aircraft, and aircraft with upgraded cabin interiors on flights to San Francisco, Frankfurt, Singapore, and a majority of metro-to-metro domestic routes.

- A premium onboard experience, Vista Verve, for its UK and US routes, with bespoke chinaware and tableware and luxe bedding.

- A refreshed in-flight menu, blending gourmet Indian and international flavours.

- Wi-Fi services on flights operated with A350, B787-9 and A321neo aircraft and an inflight entertainment system that offers 3,000 hours of content from around the world, and 1,800+ hours of curated content on passengers’ personal electronic devices.

Expanding the brandscape

Indian Hotels Company Ltd (IHCL) is also tapping into the growth opportunities in the sector. These include a limited supply in the country’s top 10 lodging markets, travel increasingly becoming a non-discretionary spend and foreign tourist arrivals expected to exceed pre-pandemic levels (arrivals increased 305.4% in 2023). IHCL’s ambitious expansion has ensured 11 consecutive quarters of record financial performance, clocking a revenue of Rs 6,078 crore in the first nine months of FY25.

Not only has the company expanded to an industry-leading portfolio of 360 hotels across 150+ locations worldwide, signing 85 hotels and opening 40 hotels in 2024 itself, but it has also exponentially grown its ‘house of brands’, where new businesses are emerging as key drivers of growth. “Indian travellers today, are seeking more diverse and personalised experiences,” says Puneet Chhatwal, Managing Director and Chief Operating Officer, IHCL. “There is growing interest in boutique and experiential offerings, homestays and adventure tourism. We will continue to expand our brandscape with the launch of new brands, tapping the heterogenous market landscape and taking our portfolio to 700 hotels by 2030.”

So, while the iconic Taj, the World’s Strongest Hotel Brand, remains at the forefront of IHCL’s growth with 19 signings in 2024 — reflective of the continuing demand for luxury experiences — the company is scaling the lean luxe segment in India through the reimagined Ginger. The brand has been revamped to appeal to millennials — two-thirds of India’s workforce and frequent travellers to boot — who are value conscious but drawn to spaces that facilitate both work and leisure.

To feed the demand for culturally-inspired spaces in micro markets, IHCL has also reimagined Gateway into a full-service hotel offering in the upscale segment. On the other hand, its Tree of Life is positioned in a fast-emerging niche market, appealing to experiential travellers, seeking unique, immersive experiences — that are therefore luxurious and exclusive — in offbeat destinations. Also designed for experiential travel, but with a premium homestay twist, is ãma Stays & Trails, a collection of bungalows that mesh heritage charm with modern comforts — another popular format among discerning travellers.

Domestic destinations dominate

As younger, influencer-driven travellers increasingly seek offbeat (and until now, often inaccessible) holidays in India, domestic tourism has been booming. According to WTTC, domestic travel spends reached Rs 14.64 lakh crore in 2024. “While they are definitely exploring the world, Indian travellers are also looking to explore their own country, visiting smaller, less explored destinations, looking for unique experiences,” says Mr Wilson. Air India has consequently ensured that its network provides access to off-the-beaten-path destinations across India. Air India Express especially offers connectivity to 90+ destinations, including smaller towns and cities such as Dibrugarh, Dimapur, Kozhikode, Ranchi and Kannur.

Similarly, IHCL’s expansion in less-explored regions like the northeast, where it has 12 hotels, is reflective of this trend. “While traditional tourist hotspots like Goa and Kerala continue to experience high demand with newer formats of hospitality, the demand in offbeat destinations is indeed surpassing the supply, especially with the region’s rich cultural and natural offerings, which are beginning to appeal to both domestic and international tourists,” says Mr Chhatwal.

The affinity for cultural experiences has led to a rise in spiritual tourism, where demand is prevalent round the year. “This is important for the sector,” says Mr Chhatwal. “The growth in infrastructure has enabled improved connectivity and accessibility to these destinations.” IHCL has a presence in 20 destinations of spiritual significance, and another 30 where spiritual tourism is one of the many facets. These destinations include key pilgrimage sites like Varanasi, Nashik, Ajmer, Rishikesh and Tirupati. There is also a pipeline of 20 hotels in Ayodhya, Hampi, Vrindavan, Ujjain and Prayagraj.

Spiritual tourism offers international opportunities as well and IHCL has signed a Taj in the holy city of Makkah. Though the company is mostly focussed on the Indian subcontinent, it is also growing internationally with the Taj brand, in markets with a strong brand recall and a significant Indian diaspora. Its international portfolio stands at 27 hotels with nine in the pipeline in markets like Bhutan and Nepal, and in Dhaka, Riyadh, Dubai, and Frankfurt.

People at the forefront

In service industries, and especially the hospitality ecosystem, building a skilled workforce is paramount for success. As consumer expectations from service become more refined, both Air India and IHCL are ensuring their skill development and training programmes remain top of the line.

At 6,00,000sq ft, the Air India Training Academy in Gurugram, is South Asia’s largest aviation training academy, where 2,000+ employees (pilots, cabin crew, engineers and security personnel) are being trained daily. Air India is addressing the growing demand for pilots with its upcoming Flying Training Organisation in Amravati, Maharashtra. Scheduled to be operational in the latter half of the year, the plan is for 180 commercial pilots to graduate every year.

For its part, IHCL is committed to skilling 1 lakh people by 2030 through its 51 skilling centres, as well as its upcoming skilling centre at the Aguada plateau in Goa, which is expected to be the country’s largest. For this initiative, IHCL is partnering with governments, institutions and private players to invest in talent pools, and supporting deserving youth and their families, while enhancing employment opportunities.

Money matters

Tata AIG General Insurance’s travel offerings have witnessed a noticeable uptick in recent years, giving it a 29% market share in FY24 (from 20% in FY20). “This is in large part due to our technology-driven strategy,” says Neel Chheda, Chief Underwriting and Data Science Officer, Tata AIG. “But there is also increasing awareness across various age groups about the importance of travel insurance.”

Several factors are influencing demand: a younger demographic that is more inclined to secure insurance before travel, increasing international travel, flexible plans and ease of buying (online). Plus, there is a market for insurance for adventure travel and increased health coverage (since the pandemic), which has prompted the company to introduce a comprehensive travel insurance product with a range of bundled plans that cover adventure sports or cruise-related contingencies, in addition to the usual travel insurance features.

When it comes to financing travel, loans are becoming increasingly popular, making up a significant portion of the Rs 14 lakh crore personal loan market in India. “Young travellers especially, are open to these lending options because they can repay leisurely over 12-36 months, plus the interest component is not prohibitively high — 11% to 18% — for an unsecured loan,” says Vivek Chopra, Chief Operating Officer-Retail, Tata Capital. “Even those fresh in the job market, who do not have a credit score to show yet but are well-employed, can access these loans.”

As forex cards increasingly emerge as the preferred international spending option, Tata Neu, the group’s super app, is launching the Tata Neu IndusInd Bank Forex Card, which will be available in the first quarter of FY26. The card is designed to be convenient (withdrawals at ATMs or directly at merchant outlets), flexible (can load up to 14 currencies) and economical (savings of up to 3.5% compared to traditional credit cards and no additional charges on international transactions, thanks to best-in-class exchange rates).

The one-stop travel shop

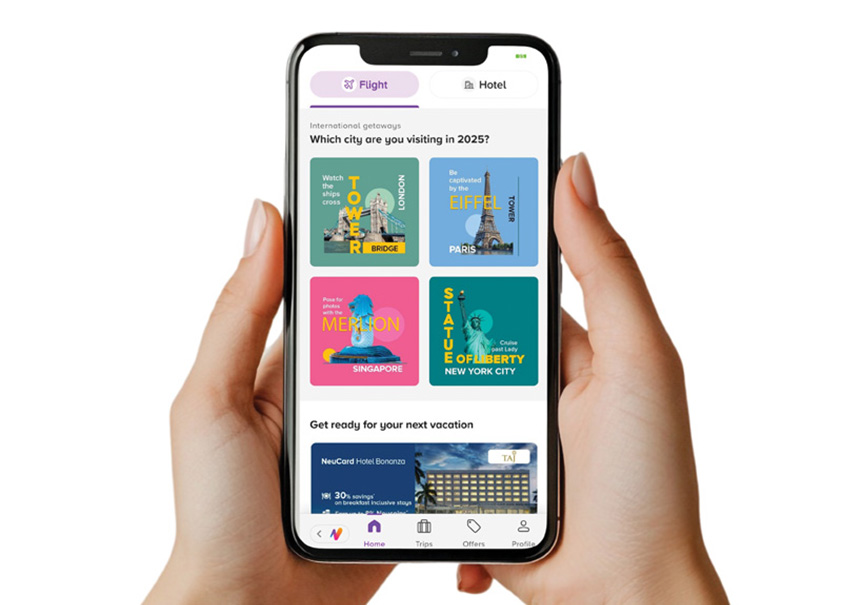

Tata Neu offers travellers a seamless, unified booking experience through its Travel Store widget that combines both hotel and flight bookings. However, unlike the average travel aggregator, Tata Neu goes a step further to fulfil every requirement a traveller may have, including shopping for various travel-related accessories, like fashion, electronics, etc.

Another significant differentiator is the host of benefits offered by NeuCard, the platform’s co-branded credit card with HDFC Bank. These include up to 10% savings on flights and hotels in the form of NeuCoins; IHCL Silver tier membership (including a 30% one-time discount on stays, meals and spa treatments) and various monthly offers. Going ahead, travellers can expect more bundled packages with partner brands, personalised travel planning tools, travel insurance add-ons and the Tata Neu Forex Card.

Tech support

Technology is the critical — but often unseen — backbone of the travel and tourism sector, which can directly impact travellers’ experience. For instance, Air India’s $200 mn investment towards modernising its digital systems has helped create seamless AI-driven reservations through its website’s eZ Booking feature, while its GenAI chatbot enhances customer experience by reducing wait times to virtually zero.

Recently, the airline collaborated with Tata Technologies to revolutionise its aircraft interiors. “We are leveraging our extensive global aerospace experience to deliver end-to-end solutions — from design and validation to weight optimisation and ergonomic considerations — all aimed at enhancing passenger experience,” says Shailesh Saraph, Executive Vice President and Global Head - Engineering Research and Development Delivery, Tata Technologies. The collaboration aligns with Air India’s achievement of the Directorate General of Civil Aviation’s Design Organisation Approval under CAR 21 (Part 21). It is the first Indian airline to obtain this level of authorisation, which empowers it to independently make changes in-house, like improving in-flight comfort through engineering solutions, integrating seamless infotainment access via personal devices, optimising weight efficiency, modifying livery for new aircraft and developing innovative seating layouts.

Air India has also partnered with Tata Consultancy Services (TCS) for its development, integration and quality assurance services. In fact, TCS has been a pioneer in transforming how India travels. It revolutionised India’s passport issuing process in 2008 through the Passport Seva Project (PSP), by implementing a streamlined fully digitised online application system. It reduced the average processing time from ~45 days to just eight days. TCS currently serves citizens from 93 Passport Seva Kendras in 63 cities, managing 1.5 crore+ applications annually and processing ~65,000 passports daily.

In 2022, TCS was selected by the Ministry of External Affairs for phase 2 or PSP-V 2.0 of the programme. Key elements include setting up a state-of-art digital ecosystem, process overhauling and integration among various stakeholders and database, improving citizen interface, upgrading technology, adopting best practices and strengthening data security.

The company has also developed TCS Adaptive Airports - Connected Traveler that enables airports to offer a frictionless traveller experience by providing them with contextual and personalised information, while empowering the airport workforce to optimise wait times at touchpoints and improve operational efficiencies.

With their diversified services in the travel and tourism sector, Tata group companies are perfectly positioned to fulfil Indian travellers’ dream holidays. It’s not just the destination, but also the journey that counts, and Tata brands are determined to make both unforgettable.

—Anuradha Anupkumar